The stress isn’t just about prices

Most people don’t think about housing all day.

But it’s always there — quietly present in the background of decisions.

Career moves feel constrained.

Relationships feel delayed.

Long-term plans feel tentative.

It’s not simply that homes are expensive.

It’s that housing now carries emotional weight it didn’t before.

For many, it feels like life can’t properly start until this box is checked — even as the box keeps moving farther away.

The common explanation focuses on personal choices

Housing pressure is often explained through behavior.

People didn’t save enough.

They want too much house.

They didn’t buy early enough.

These explanations sound reasonable.

They’re also incomplete.

They assume housing is still primarily shelter — a functional purchase tied to income and need.

It isn’t.

Housing became something else.

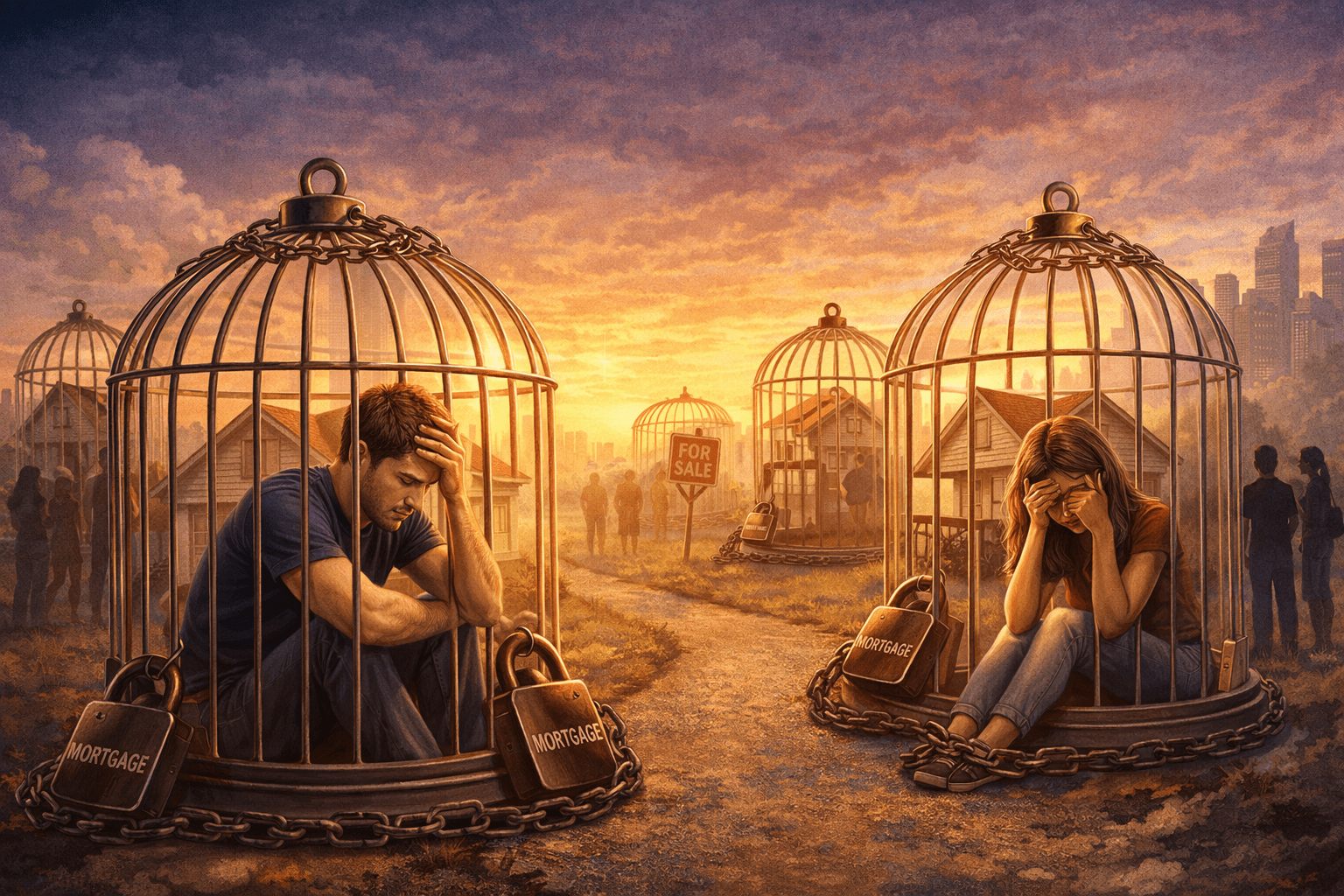

When shelter turned into a financial identity

Over time, housing absorbed multiple roles.

It became:

-

a store of wealth

-

a forced savings vehicle

-

a status signal

-

a proxy for adulthood

As prices rose faster than wages, owning a home stopped being a step in life and became a dividing line.

Those who crossed it early gained stability, leverage, and confidence.

Those who didn’t felt increasingly dislocated — regardless of effort or responsibility.

The home wasn’t just shelter anymore.

It was position.

Why this creates psychological pressure, not just financial strain

When housing prices rise faster than income, the damage isn’t limited to affordability.

It affects perception.

People begin to feel:

-

late

-

behind

-

ungrounded

Renting starts to feel temporary — even when it’s long-term. Saving starts to feel futile — because the target moves faster than progress.

This creates a specific kind of stress: not fear of poverty, but fear of never arriving.

That pressure compounds quietly.

Timing matters more than discipline

Two people can behave identically and experience completely different outcomes based on timing alone.

One buys before prices accelerate.

The other saves responsibly while prices run away.

The first looks prudent.

The second looks careless — unfairly.

This isn’t a lesson about intelligence or effort.

It’s about exposure to a system at a specific moment.

Housing rewards early entry more than good behavior.

Why renting feels unstable even when it’s rational

From a purely financial perspective, renting can make sense.

But psychologically, it often doesn’t.

That’s because renting offers shelter without anchoring. It lacks the permanence, predictability, and control people associate with adulthood.

When ownership becomes the default marker of progress, renting feels like suspension — even if it’s strategic.

This mismatch between logic and emotion is where the trap tightens.

What high performers tend to see earlier

People who navigate housing pressure well don’t treat ownership as a milestone.

They treat it as a tool.

They separate:

-

shelter from status

-

timing from worth

-

leverage from identity

They understand that housing decisions shape optionality for decades — and that the wrong purchase can restrict life more than no purchase at all.

Ownership isn’t freedom by default.

It’s commitment.

How this fits into the larger pattern

This is where the Capital sequence converges.

Currency erosion pushes people toward assets.

Market volatility increases fear of missing out.

Housing becomes the most visible, emotionally charged asset of all.

So people chase stability — and feel trapped when they can’t reach it.

Not because they failed.

Because the system changed.

A clearer way to see housing

Housing isn’t just expensive.

It’s overloaded.

It’s carrying expectations it was never meant to bear — financial security, identity, timing, and legitimacy all at once.

The more people understand that, the less power the trap holds.

The real question isn’t “When can I buy?”

It’s:

“What does this decision give me — and what does it quietly take away?”

That question doesn’t make housing easier.

It makes it clearer.

0 Comments